Washington’s State Theatre – Photo by Sally Y. Hart

As tax reform is discussed and considered in Washington, D.C., there are local partners working on projects in Washington, Iowa, concerned about the future of the federal Historic Tax Credit.

At the recent Washington City Council meeting Main Street Washington Director Sarah Grunewaldt explained the program has helped fund programs locally. She requested a show of support from the city council, “I would like council to consider a resolution supporting the federal Historic Tax Credit because we have several projects that I’ve been working on that would benefit from the tax credits, that are only going to happen if those tax credits are in place. Some of those like the Goncho Apartment Building if you want to see that redeveloped, the calendar factory, the Captain’s Table, those projects are going to be very expensive and this does not line the pockets of developers, this gets those projects done. So I’d like you to consider a resolution.”

Grunewaldt said the State Theatre is one finished project that benefited from these tax credits, “And Main Streeters know that the federal tax credits are very important for getting some of our smaller projects in our smaller towns done. Yes, it happens in cities all the time, but the State Theatre is one of the projects in Washington that has benefited.” Grunewaldt tells KCII News, “According to the numbers the State Theatre could have claimed up to $156,514 in Federal Historic Tax Credits.”

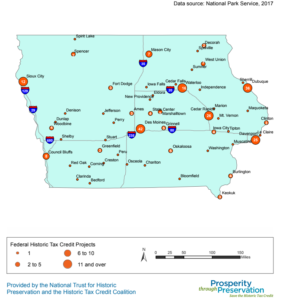

The National Park Service shows that from 2002 to 2016 Iowa has had 257 projects receive such funding, resulting in over $1 billion in total development. According to the National Trust for Historic Preservation, the program helps revitalize communities and spur economic growth, “the HTC returns more to the Treasury than it costs — $1.20-1.25 in tax revenue for every dollar invested.” The council did not yet take formal action on the matter.