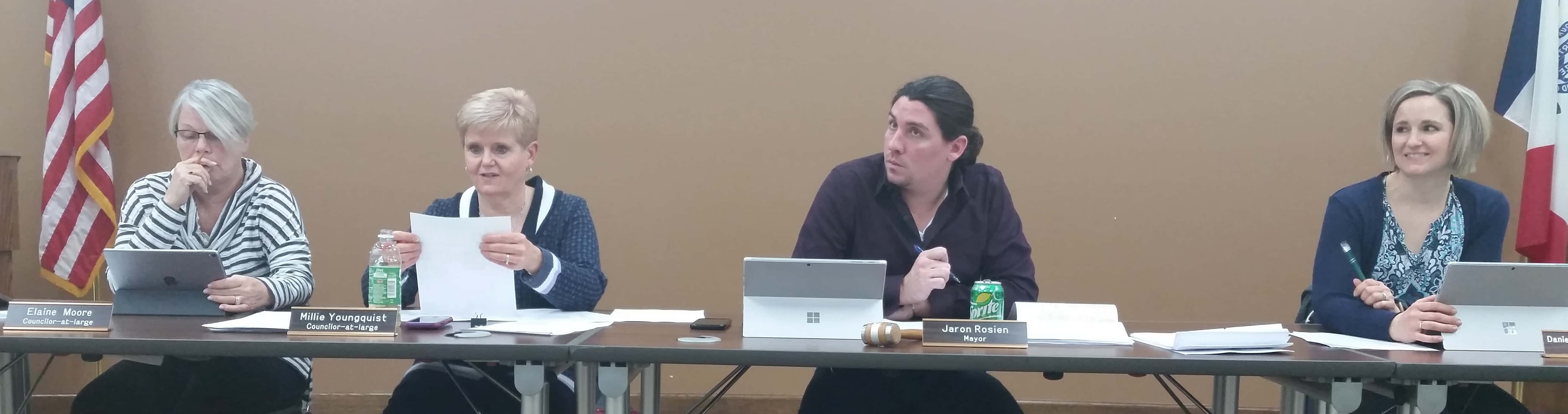

Washington Mayor Jaron Rosien took some time at this week’s council meeting to talk about tax rates for the City and those for Washington County. He explained that after seven years of the same tax rate, the City lowered it this year coinciding with the county’s emergency communications funding, “We lowered our levy by 60-cents per $1,000 in valuation. This is specifically because of how the county, which is different from the city, different than the schools, but how the county is changing how they levy for communications. As a city we adjusted our budget down to the exact tune that the county brought theirs up in this category.”

Earlier this month, the Washington County Board of Supervisors approved the Fiscal Year 2020 budget which included a 9.7% increase on property tax asking. Those increases include moving the communication levy from the cities to the county, as well as courthouse security measures and a new ambulance. Had the county not had such projects, the increase would have been 1.8%. The City of Washington’s property tax rate is $15.22 per $1,000 assessed value. The County’s property tax rate is $8.21 in urban areas and $11.1654 in rural areas.

Find KCII’s initial stories about the City taxes and County taxes with these links.