In August, U.S. Senate democrats passed their new climate, health, and tax package, with nearly $80 billion of that bill being distributed to the IRS over the next ten years. More than half of the money is meant for enforcement. The IRS says that the increase in funding is so that they are better equipped to go after high-income tax evaders.

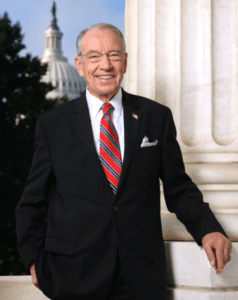

Sen. Charles Grassley voted against this new bill and spoke with KCII about how he believes the budget increase for the IRS is not addressing a significant problem. “The fact is you can’t get an answer to your questions. Only one out of every ten calls to the IRS gets a real person, so if you can’t get an answer to your question, how exactly are you going to be able to pay your taxes correctly?

The main goal of increasing funding for the IRS is to increase the revenue brought in through tax collection from the wealthy. Sen. Grassley believes that the revenue increase will come from the middle class and not from the wealthy. “The IRS presently brags about going after the big corporations and the very wealthy. So, if you add another 87,000 agents on, they’re going to go after the middle class, they’re going to intimidate them and send them a bill for $1000 or $5000, and instead of hiring a lawyer, most people will just pay it to get the IRS off their back. That’s how they are going to increase revenue through intimidation.”

Election Day is November 8th, and registered Iowa voters can now apply for absentee ballots for the upcoming election.